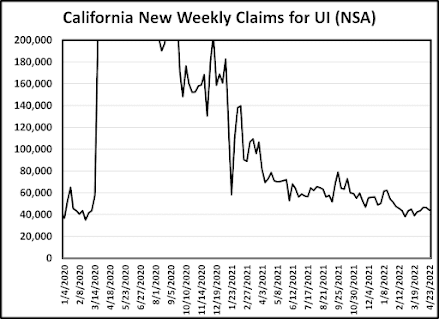

The good news is that after creeping up for a few weeks, new weekly claims for unemployment benefits in California have leveled off and even turned down a bit. The bad news - although not reported that way in the news media - is that first quarter real GDP at the national level turned down. News stories report that this turning down is just a fluke and note that it was due to an increased negative international trade balance, inventories falling, and reduced federal, state, and local government spending. But at the end of the day, the negative number means less economic activity in the U.S.

If consumers and others are relying more on imports (things not made in the U.S.), if foreigners have less desire for U.S. exports, and if governments are spending less, why is that considered a fluke? If inventories are falling, you surely want to know why? Are suppliers not restocking their inventories because they think a slowdown in demand is coming soon? Maybe with the Federal Reserve threatening more interest rate hikes to deal with inflation, they have reason to expect such a slowdown. Maybe higher interest rates mean that the cost of maintaining inventories is higher.

In short, there is a lot of uncertainty out there. The chickens have yet to hatch. So maybe it's too soon to count them.

As always, the new claims data are at https://www.dol.gov/ui/data.pdf.

No comments:

Post a Comment